From Bicycles to Batteries: How the EV Bubble Echoes Victorian Velocity

When the British bicycle bubble burst in 1897, it wasn't just wheels and gears that came crashing down. It was human nature on full display.

And yet, despite the calamity, history keeps pedaling forward, repeating the same script with new actors.

Fast forward over a century, and we find ourselves in the throes of another speculative fever: Electric Vehicles (EVs).

Let's take a closer look.

The bicycle craze of the late Victorian era wasn't just about bicycles—it was about freedom, modernity, and technological marvel.

Sound familiar?

Today, EVs stand as symbols of environmental consciousness, technological prowess, and visionary futurism.

Early believers, much like their bicycle-loving ancestors, have already banked fortunes.

Just consider Tesla’s stock, which soared over 740% in 2020 alone, catapulting Elon Musk to the richest man in the world..

But remember Ernest Terah Hooley?

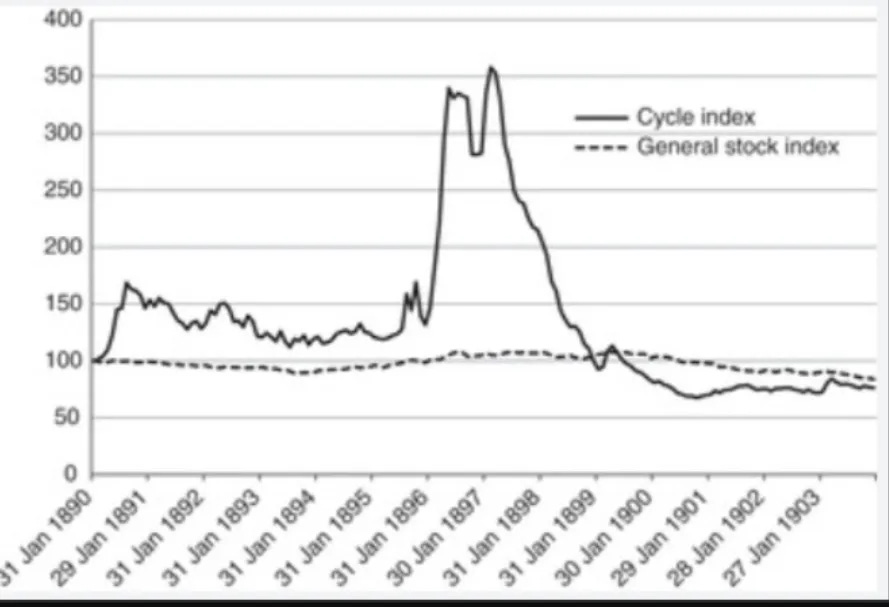

He was the EV evangelist of his day, selling dreams of limitless growth for Dunlop Pneumatic Tyre Company shares, which shot up an astonishing 1,138% in a single season.

At its peak, British bicycle stocks had convinced investors they were riding into infinite profitability. It was classic "this time it's different" territory, backed by supposedly rock-solid fundamentals and propelled by relentless hype.

Today, EV valuations echo these sentiments, though now it's Morgan Stanley analysts performing intellectual acrobatics to justify sky-high valuations.

Consider Tesla: Its profits derive largely from regulatory credits, not car sales. Yet investors buy into the promise of autopilot technology, energy storage solutions, insurance services, and more, assigning valuations that demand flawless execution for decades.

Does this echo the "robust faith in the gullibility of the average investor" that The Economist once lamented about bicycle stocks?

Indeed, EVs, like bicycles, will likely become ubiquitous.

But ubiquity doesn't ensure perpetual profits.

By 1898, bicycle stocks plunged 71% from their peaks; over 80% of the bubble's participants went bankrupt. The revolution in transportation endured; the investors, unfortunately, did not.

Why do we repeat this cycle?

Behavioral finance tells us it’s simple: greed, fear of missing out (FOMO), and recency bias drive investors into a frenzy.

We dismiss the lessons of past bubbles—be it tulip mania, bicycles, dot-coms, or crypto—with an almost ritualistic fervor.

Warren Buffett wisely remarked, “Be fearful when others are greedy, and greedy when others are fearful.” Yet we seem perpetually caught in the grip of collective financial amnesia.

What's the practical takeaway? Investors should maintain cautious optimism about EVs. Recognize the signs of speculative excess.

Avoid chasing stories at any price. Set disciplined entry points. Perhaps, as Mark Cuban demonstrated brilliantly when selling Yahoo near its peak, lock in gains by using prudent hedging strategies.

So here's my forecast: Tesla, Rivian, Lucid, and their electric brethren may indeed change the world—but their stocks will likely plummet from today's dizzying heights. In a decade or two, they'll be remembered fondly, like the bicycles that reshaped Britain.

So, the next time you hear "this time it's different," remember those Victorian cyclists. History may not repeat exactly, but it certainly rhymes.

Don't be the investor left holding the handlebars when the music stops.